How To Calculate Mileage Cost Nz . how our fuel cost calculator works. In accordance with s de 12 (4) the. The tier 1 rate is a combination of your vehicle's fixed and. the 2023/2024 kilometre rates have been published. You can find them on our website. the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure claims. Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle.

from studylib.net

use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. You can find them on our website. mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. In accordance with s de 12 (4) the. how our fuel cost calculator works. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure claims. The tier 1 rate is a combination of your vehicle's fixed and. the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. the 2023/2024 kilometre rates have been published.

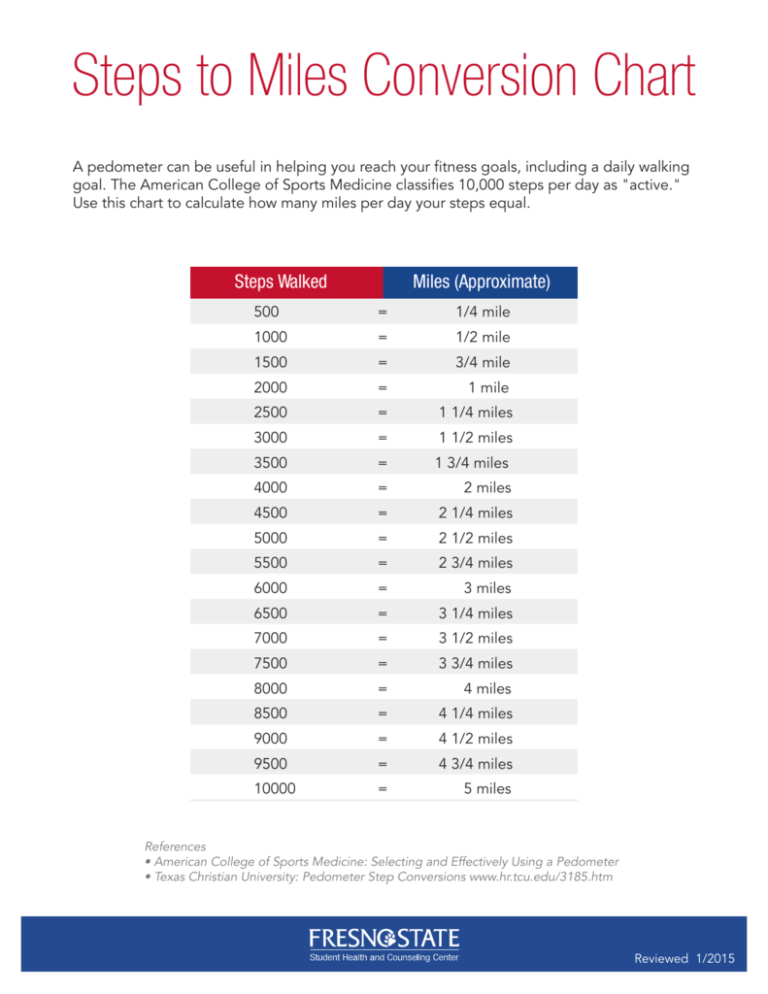

Steps to Miles Conversion Chart

How To Calculate Mileage Cost Nz You can find them on our website. the 2023/2024 kilometre rates have been published. In accordance with s de 12 (4) the. The tier 1 rate is a combination of your vehicle's fixed and. use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure claims. Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. how our fuel cost calculator works. mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). You can find them on our website.

From www.sdpuo.com

How To Calculate Mileage A Comprehensive Guide The Cognitive Orbit How To Calculate Mileage Cost Nz calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure claims. how our fuel cost calculator works. In accordance with s de 12 (4) the. mileage rate is a term that refers. How To Calculate Mileage Cost Nz.

From www.thetechedvocate.org

How to calculate miles per year The Tech Edvocate How To Calculate Mileage Cost Nz In accordance with s de 12 (4) the. the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure. How To Calculate Mileage Cost Nz.

From danakarenrutherford.blogspot.com

how to calculate mileage claim in malaysia Karen Rutherford How To Calculate Mileage Cost Nz mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure claims. use. How To Calculate Mileage Cost Nz.

From jadabgiulietta.pages.dev

Mileage Reimbursement 2025 Calculator Elka Martguerita How To Calculate Mileage Cost Nz the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure claims. mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. The tier 1 rate is a combination of your vehicle's fixed and. calculate daily, monthly & yearly fuel costs. How To Calculate Mileage Cost Nz.

From ihsanpedia.com

How To Calculate Mileage A Comprehensive Guide IHSANPEDIA How To Calculate Mileage Cost Nz Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. The tier 1 rate is a combination of your vehicle's fixed and. use our kilometre rates to calculate the. How To Calculate Mileage Cost Nz.

From www.youtube.com

Mileage Claims How to calculate and claim mileage expenses using How To Calculate Mileage Cost Nz Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. You can find them on our website. use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. the 2023/2024 kilometre rates have been published. In accordance with s de 12 (4). How To Calculate Mileage Cost Nz.

From www.wikihow.com

How to Calculate Mileage for Taxes 10 Steps (with Pictures) How To Calculate Mileage Cost Nz use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. The tier 1 rate is a combination of your vehicle's fixed and. Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. calculate daily, monthly & yearly fuel costs for petrol. How To Calculate Mileage Cost Nz.

From myrtabdevondra.pages.dev

2024 Mileage Rate Nz Car Gusty Katusha How To Calculate Mileage Cost Nz mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. the 2023/2024 kilometre rates have been published. the rates set out below apply for the 2021/2022. How To Calculate Mileage Cost Nz.

From www.wikihow.com

How to Calculate Mileage for Taxes 8 Steps (with Pictures) How To Calculate Mileage Cost Nz mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. how our fuel cost calculator works. the rates set out below apply for the 2021/2022 income year for business motor vehicle. How To Calculate Mileage Cost Nz.

From www.omnicalculator.com

Steps to Miles Calculator How To Calculate Mileage Cost Nz The tier 1 rate is a combination of your vehicle's fixed and. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. In accordance with s de 12 (4) the. the table. How To Calculate Mileage Cost Nz.

From www.youtube.com

How to calculate mileage of scooty? YouTube How To Calculate Mileage Cost Nz You can find them on our website. the rates set out below apply for the 2021/2022 income year for business motor vehicle expenditure claims. In accordance with s de 12 (4) the. how our fuel cost calculator works. mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement. How To Calculate Mileage Cost Nz.

From mileagestopper.com

How to calculate annual cost per mile Mileage Stopper How To Calculate Mileage Cost Nz use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). In accordance with s de 12 (4) the. Our calculator factors in the length of your trip, the fuel efficiency of. How To Calculate Mileage Cost Nz.

From ceewarih.blob.core.windows.net

How To Calculate Gas Cost By Mileage at Oscar Permenter blog How To Calculate Mileage Cost Nz the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. the 2023/2024 kilometre rates have been published. how our fuel cost calculator works. The tier 1 rate is a combination of your vehicle's fixed and. mileage rate is a term that refers to a monetary rate set by the tax authority for. How To Calculate Mileage Cost Nz.

From www.yttags.com

The Mileage Calculator Yttags How To Calculate Mileage Cost Nz Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). The tier 1 rate is a combination of your vehicle's fixed and. the 2023/2024 kilometre rates have been published. In accordance with. How To Calculate Mileage Cost Nz.

From www.youtube.com

[SOLVED] HOW TO CALCULATE MILEAGE OF CNG CAR? YouTube How To Calculate Mileage Cost Nz In accordance with s de 12 (4) the. the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. The tier 1 rate is a combination of your vehicle's fixed and. Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. You can find them on our website.. How To Calculate Mileage Cost Nz.

From www.youtube.com

How to calculate car mileage bike mileage easy way YouTube How To Calculate Mileage Cost Nz You can find them on our website. In accordance with s de 12 (4) the. Our calculator factors in the length of your trip, the fuel efficiency of your vehicle (in miles per. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). the 2023/2024 kilometre rates have been published.. How To Calculate Mileage Cost Nz.

From towinghome.com

How to Calculate Gas Mileage & Easy MPG Calculator Towing Home How To Calculate Mileage Cost Nz how our fuel cost calculator works. mileage rate is a term that refers to a monetary rate set by the tax authority for mileage reimbursement or deductions. calculate daily, monthly & yearly fuel costs for petrol (gas) or diesel vehicles (fuel cost calculator new zealand). the rates set out below apply for the 2021/2022 income year. How To Calculate Mileage Cost Nz.

From www.apexcapitalcorp.com

How to Calculate Cost per Mile for Trucking How To Calculate Mileage Cost Nz the table of rates for the 2022/2023 income year for motor vehicle expenditure claims. You can find them on our website. In accordance with s de 12 (4) the. how our fuel cost calculator works. use our kilometre rates to calculate the deduction for costs and depreciation for the business use of your vehicle. mileage rate. How To Calculate Mileage Cost Nz.